It’s better to be a straight shooter with the irs and avoid the wild west of tax evasion. Onlyfans is a global business and we comply with the applicable tax laws and regulations in the jurisdictions in which we operate This guide explains important tax considerations for u.s

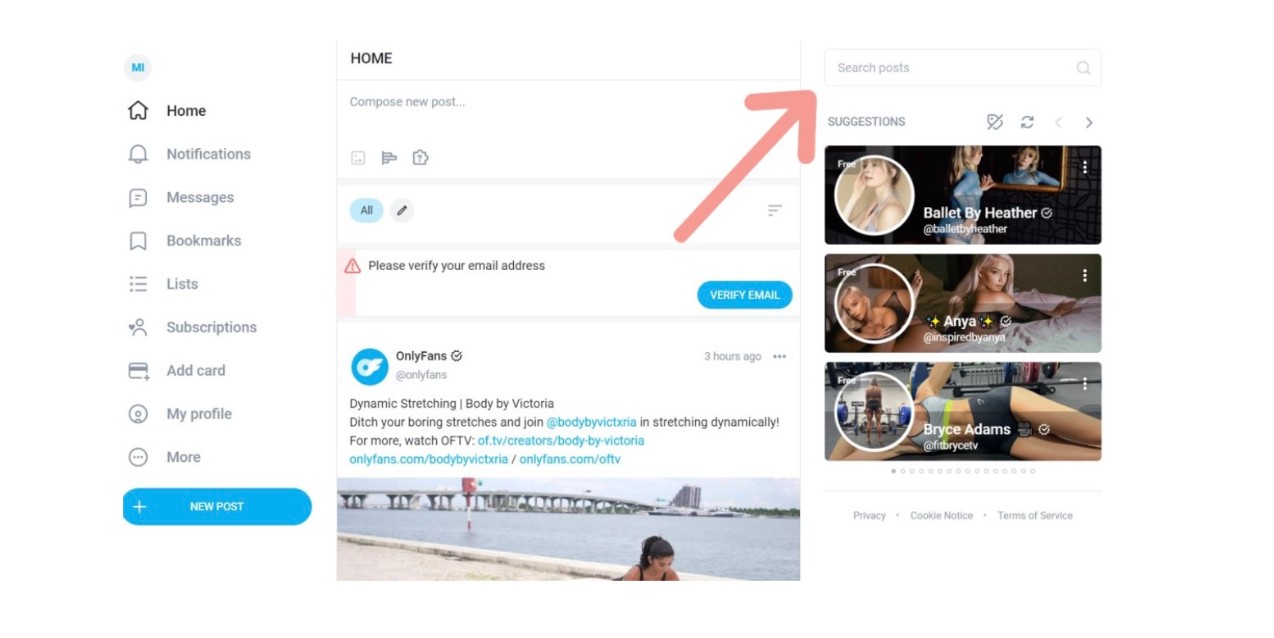

I Tried OnlyFans for a MONTH and made $____ SO MUCH MONEY!! || Only...

Learn how to pay less taxes as an onlyfans creator

Discover 5 legal tax deductions that can save you thousands in 2025!

Yes, as a onlyfans content creator you are self employed How much can i make before i have to pay taxes/report the income If you have to file for other reasons, you have to include all your onlyfans income as well, otherwise if you make a profit of $400, or if you are paid $600 to your account in one year, you are expected and required to. Do i have to claim onlyfans on my taxes