It’s better to be a straight shooter with the irs and avoid the wild west of tax evasion. Discover 5 legal tax deductions that can save you thousands in 2025! This guide explains important tax considerations for u.s

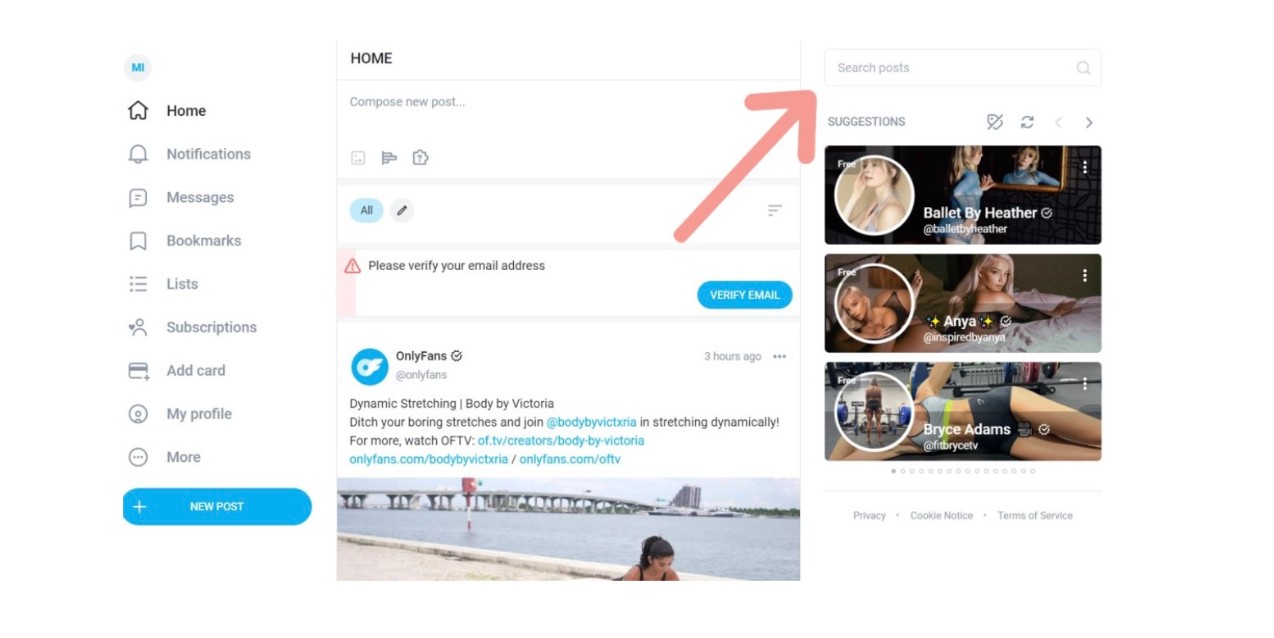

如何在OnlyFans上找人:分步教學(2024年)

The questions are asking what is the business name and federal tax classification

Is the business name my name or onlyfans

Since technically the site is the “middle man” with the money Yes, as a onlyfans content creator you are self employed How much can i make before i have to pay taxes/report the income If you have to file for other reasons, you have to include all your onlyfans income as well, otherwise if you make a profit of $400, or if you are paid $600 to your account in one year, you are expected and required to.

Learn how to pay less taxes as an onlyfans creator